Regenerative Finance (ReFi)

Stefan Grasmann, Managing Director Competence Center at Zühlke

Regenerative Finance is a new, noteworthy trend in the blockchain space and describes a subset of Decentralised Finance (DeFi) projects. ReFi projects aim to promote the Sustainability Development Goals (SDGs) and use their services to increase the transparency, accessibility and profitability of social and environmental projects.

Similar to how DeFi develops an open, accessible financial marketplace and addresses limitations of the traditional financial system, ReFi projects seek to attract new investors to SDG projects. This is intended to increase demand and ultimately attract more capital to these projects, for example to address climate change.

From DeFi to ReFi

Technically, the ReFi movement is based on DeFi building blocks, such as blockchains, standardised tokens and decentralised exchanges (DEX). Open source is also part of the standard.

At the same time, ReFi adopts many social and organisational approaches from DeFi by relying on token economies and DAOs. DAO stands for Decentralised Autonomous Organisation — a new form of organisation whose members use DAO tokens to help determine the direction of the project. The concrete design of the projects is also in the hands of the community, for example through contributions to programming, documentation, marketing or community management. Members are co-owners of the DAO via their tokens and are interested in their increase in value.

A final important ReFi building block is the ethos of open accessibility — ReFi services are designed to be permissionless, analogous to DeFi services: Anyone can contribute and use them. That’s why most projects are complementary and “plug-and-play”. Insiders like to talk about Lego Building Blocks that make the difference and result in a dramatic speed of innovation.

ReFi & Climate

A major thrust of ReFi is to address climate issues and Sustainability Development Goal number 13: “Climate Action”. For example, several projects aim to put CO2 certificates — in most cases so-called carbon credits — on a blockchain (“on-chain”) and make them accessible to existing DeFi services. This will make CO2 certificates a central building block in the emerging decentralised financial system.

Green investments are becoming blockchain-enabled.

The easiest way to explain the interplay is by diving into some concrete examples.

The Toucan Protocol

Photo by Neil Yonamine: https://www.pexels.com/photo/toucan-perching-on-branch-11692041/

The Toucan Protocol’s mission is to transform CO2 certificates for voluntary carbon offsets from trusted sources into corresponding tokens on the Polygon blockchain. Toucan relies on Verra’s Verified Carbon Standard (VCS) for this purpose. Environmental projects can issue Verra certificates if they demonstrably offset CO2 emissions over several years — for example, through reforestation projects. These certificates are usually sold on a traditional CO2 market — and bought by CO2 emitters to be destroyed, thus offsetting their negative CO2 balance.

Access to traditional CO2 markets is considered cumbersome.

Transparency is limited.

The goal of the Toucan Protocol is to make this complex and rather closed market more accessible, liquid and thus more attractive for all parties. To do this, CO2 certificates must be tokenised to make them available and tradable on blockchains.

The tokenisation process is handled by the Toucan Bridge.

Its main task is to verifiably eliminate CO2 certificates in the off-chain Verra Registry and to make them available on-chain instead.

The Toucan Bridge is deliberately designed as a “one-way street” to make it impossible for CO2 savings to be credited more than once.

The Toucan Bridge works as follows (see here for details):

In a first step, Toucan generates a non-fungible token (NFT) on the blockchain for each CO2 certificate contributed. This CO2 NFT adopts the certificate’s attributes one-to-one (e.g. CO2 tons, project duration, project location, etc.). However, most DeFi marketplaces do not work with NFTs, but based on fungible tokens, which do not differ from each other. Toucan therefore bundles similar CO2 NFTs into dedicated token pools (TCO2 tokens), values these pools, and finally generates fungible, levelled CO2 tokens that correspond to the offset of approximately one ton of CO2. These tokens are called Base Carbon Tonnes (BCT) tokens and are comparable to already established CBL Global Emissions Offset Futures (GEO), which airlines use to offset CO2.

The BCT token provides users with a standardised ERC20 token that they can use like any other cryptocurrency. They can buy and hold it to speculate on an increase in value. But they can also deposit it as collateral in DeFi applications to borrow it or resell it later. Andthey can “burn” it, for example to offset their own carbon footprint.

In addition to the more general BCT token, Toucan has recently started to provide Nature Carbon Ton tokens (NCT). These tokens function similarly to BCT, but are limited to CO2 certificates from nature-based, ecological projects that, in addition to their CO2 reduction, achieve other positive effects in the sense of the Sustainability Development Goals, such as fair wages or groundwater protection. Because of their broader impact beyond climate protection, NCTs are traded at a higher price than BCTs.

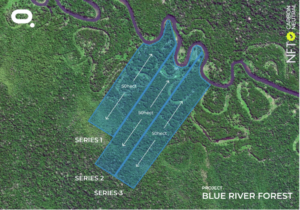

The example MOSS

MOSS, which has its roots in South America and is dedicated to the protection of the Amazon rainforest, is positioned very similarly to Toucan. On the one hand, MOSS issues its MCO2 token, which is also based on certificates that meet the Verra standard. However, one focuses strongly on rainforest protection projects around the Amazon compared to Toucan. Excitingly, MOSS has also entered the NFT market and offers conservation parcels of 50 hectares of rainforest to interested parties. These NFTs can be purchased on the NFT marketplace Opensea, which is more known for NFT-based art projects. MOSS uses modern technology such as satellite monitoring and artificial intelligence to demonstrate permanent protection of the virgin forest.

Screenshot from MOSS NFT on OpenSea

DAOs bring a lot together

ReFi would not live up to its name if it remained with individual token building blocks such as BCT, NCT or MCO2. Ultimately, these CO2 tokens only form the basis for the overarching goal: a freely accessible, liquid and scaling market for environmental protection assets.

This is where DAO communities like KlimaDAO come into play. KlimaDAO buys as many CO2 tokens as possible in order to “hoard” them in its treasury — thus withdrawing them from circulation and increasing the price of the remaining or new certificates. KlimaDAO declares itself as a “black hole for CO2”.

This approach is intended to make environmental protection projects economically more attractive.

KlimaDAO is entering a competitive market in which large companies such as Microsoft or Amazon committed themselves to a neutral or even negative CO2 balance. These companies produce significant amounts of CO2 in their core businesses, such as operating large cloud data centres, and are forced to make up the difference through voluntary CO2 offsets. The price of these offsets could rise significantly if KlimaDAO’s plans work out.

After its launch in October 2021, KlimaDAO managed to collect tokens equivalent to 17 million tons of CO2 — in just six months. This is roughly equivalent to the annual CO2 emissions of a country like Croatia or an amount of around 50 million euros. What sounded like an audacious plan already caused a stir and was picked up by renowned media such as the Wall Street Journal.

This success is based on sophisticated incentive mechanisms for the KlimaDAO community — again inspired by DeFi (in this case the OlympusDAO project): KlimaDAO sells its in-house KLIMA tokens at a reduced price if members contribute CO2 tokens to the project instead of purchasing KLIMA tokens on the open market. In return, KlimaDAO promises not to resell the collected CO2 tokens, but to hold them in its DAO treasury — or burn them. Anyone can verify this promise at any time thanks to blockchain technology. The accumulated CO2 tokens give the KLIMA token intrinsic value and credibility.

KlimaDAO attracted a lot of attention with its approach —especially in the crypto scene. The KLIMA token experienced a rapid price increase in its first months — up to a market capitalisation of one billion euros. In the first step, however, the project failed to provide a conclusive answer to the question of what to do now with the collected CO2 token stock. Accordingly, the price of the KLIMA token fell and is now at a more realistic level — roughly on par with the CO2 values that the project has accumulated in its treasury. Despite this turbulence, the DAO currently has a respectable 40,000 members who call themselves “Klimates.”

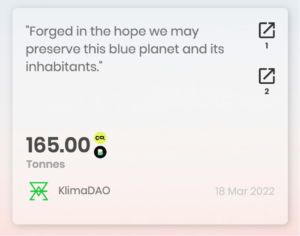

Since February 2022, KlimaDAO launches a second phase of its ambitious activities with the project “Klima Infinity”: With a new website and a 4-step plan, it targets institutional and private users who want to offset their carbon footprint and become “climate positive”. Cryptocurrencies and blockchain mechanics continue to form the basis but are increasingly taking a back seat on the website.

Users aren’t expected to fully understand the technology, it’s all about their benefits. It even gets emotional: with the “Love letter to the planet”, users can offset their carbon footprint and leave a message for their children or grandchildren in the process.

Screenshot from https://www.loveletter.klimadao.finance/

This message is recorded in the blockchain transaction and is thus immortalised. KlimaDAO has used this to offset its own carbon footprint and stored a corresponding retirement message in the transaction:

![]()

Projects on many levels

Toucan, MOSS, and KlimaDAO are just a few prominent examples of ReFi in the fight against climate change. The field is broad. Here are a few more pointers to interesting projects:

The Blockchain for Climate project addresses the implementation of Article 6 of the Paris Climate Agreement with its BITMO platform on the Ethereum blockchain and promotes certificate trading at the state level. The ixo Foundation aims to create an “Internet for Impact” based on the Cosmos blockchain. Regen Network is already building its third generation blockchain — also on Cosmos — with its Regen Ledger, which also addresses CO2 offsets with its Regen Registry and has recently partnered with Toucan.

The ReFi lego building blocks are increasingly interlocking.

Blockchains & energy consumption — an area of tension

Blockchains have a reputation for consuming an extremely large amount of energy. Doesn’t this argue against their use for sustainable purposes?

This bad reputation is especially true for so-called proof-of-work blockchains like Bitcoin — and is often used as a killer argument against any blockchain-based innovation. All projects presented in this article rely on alternative blockchains that run on proof-of-stake or, as in the case of Ethereum, will switch to proof-of-stake very soon (expected for the second half of 2022). Current research shows that this can reduce energy consumption by 99.95%, because here the consensus of the Blockchain is no longer ensured by computing tasks (work), but by the capital employed (stake).

The future for blockchain-based applications belongs to proof-of-stake. However, it is doubtful whether Bitcoin will ever undergo such a “green transformation”. So, we need to differentiate what we actually talk about.

Conclusion

There is a lot happening in the blockchain environment to use the novel technology for positive and sustainable purposes. Very high on the agenda is the trading of various CO2 certificates. A common pattern here is the tokenisation of certificates that prove the positive impact of projects in the “real world.”

On the one hand, this tokenisation creates a whole new kind of transparency and accessibility for customers from all over the world. On the other hand, accepted token standards are used and make such tokens compatible with DeFi protocols.

Both are an important basis for a flourishing market that provides us with a new lever in the fight against climate change.

Further reading: You can find more articles about Blockchain and DeFi on my blogs on Medium.

Disclaimer: This article is not intended to be an investment advice of any sort. Do your own research and search for professional support if you intend to invest in one of the projects mentioned in this article.

About the author

Stefan Grasmann is Managing Director Technology at Zühlke Germany. He works at the intersection of new tech and new work – constantly driving the organisation to the next level. Additionally, he is pushing Zühlke’s business in the blockchain area.